California SB 261: Climate-Related Financial Risk Act

California’s Climate-Related Financial Risk Act (SB 261) establishes mandatory climate-related financial risk disclosures for large companies doing business in California. It requires covered entities to publicly disclose their exposure to climate-related financial risks and the actions they are taking to mitigate and adapt to those risks. The law is modeled after the Task Force on Climate-related Financial Disclosures (TCFD) framework.

This law was passed alongside SB 253: Climate Corporate Data Accountability Act, forming part of California’s broader effort to enhance corporate climate transparency and accountability.

California SB 261 Summary

Status: In effect

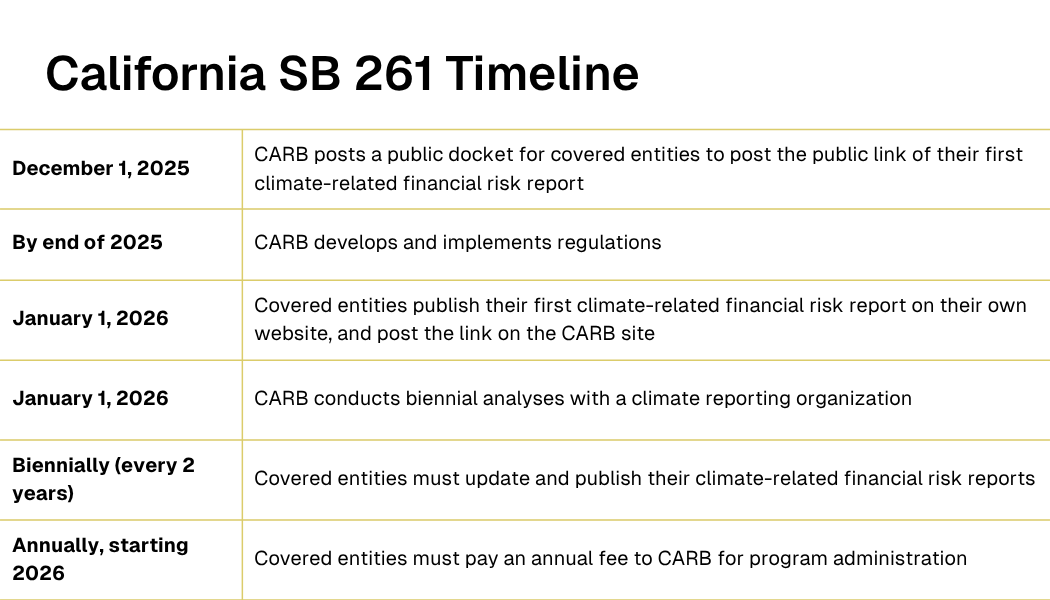

SB 261 applies to all corporations, partnerships, limited liability companies, and other business entities with annual revenues over $500 million that operate in California. These covered entities must assess and publicly disclose their climate-related financial risks every two years, beginning in 2026. Reports must follow the TCFD framework or a comparable standard and be published on their own websites.

The law also requires the California Air Resources Board (CARB) to contract with an independent climate reporting organization to analyze a representative sample of these disclosures. This analysis will be used to assess systemic financial risks posed by climate change to California’s economy and identify reporting gaps across sectors.

Entities that fail to meet reporting requirements may face administrative penalties of up to $50,000 per reporting year.

California SB 261 Requirements

The law requires covered entities to:

- Prepare and publish a climate-related financial risk report every two years, starting in 2026.

- Disclose both:

- The material risks of climate change to their operations, supply chains, investments, and financial health.

- Measures adopted to reduce or adapt to these risks.

- Use the TCFD framework, or an equivalent standard such as the IFRS Sustainability Disclosure Standards issued by the International Sustainability Standards Board.

- Publish the report on their own website, making it publicly accessible.

- Pay an annual fee to CARB to cover the costs of implementation and oversight.

Covered entities may consolidate reports at the parent company level. If they are unable to fully report, they must explain the gaps and outline steps for future compliance.

CARB, through a third-party climate reporting organization, will:

- Review and analyze climate risk disclosures from a subset of entities.

- Identify sector-wide risks and vulnerable communities.

- Recommend best practices for reporting and define what constitutes an "inadequate" report.

- Monitor federal and global developments in climate risk disclosure standards.

Federal and legal challenges impacting California SB 261

On February 3, 2025, a federal court dismissed portions of a lawsuit against SB 253 and SB 261. The court found the claims were premature, as the CARB has not yet finalized implementing regulations. However, certain claims may be refiled once the rules are in place. While CARB is statutorily required to adopt final regulations by July 1, 2025, the agency has since indicated that the timeline will likely extend into 2026.

On April 9, 2025, a U.S. federal executive order titled “Protecting American Energy from State Overreach” was signed, directing the U.S. Attorney General to identify and challenge state-level climate laws and policies that may be unconstitutional or preempted by federal law. As a result, the implementation or enforceability of state regulations such as California’s SB 261 may be subject to legal review or change.

How ClimatePartner supports compliance with California SB 261

ClimatePartner helps companies comply with CA SB 261 by leveraging its expertise in carbon accounting, climate risk and opportunity assessment, and transparent reporting:

- Identification of physical and transition risks and opportunities

- Prioritization and financial quantification of impacts

- Stakeholder engagement

- Identification of risk management options

- Disclosure statements