Navigating the SEC's new climate-related disclosures for investors rule

March 20, 2024

By Gregg Demers, ClimatePartner USA

Update May 2025: In March 2025, the SEC announced it would no longer defend the legal challenges against its climate disclosure rule. The rule, which was previously stayed in March 2024, remains under court proceedings and is unlikely to take effect in the near term.

In a widely awaited ruling, the U.S. Securities and Exchange Commission (SEC) has taken significant strides to mandate climate-related disclosures. On March 6, 2024, the SEC adopted rules to enhance and standardize climate-related disclosures by public companies. This move marks a crucial step towards fostering transparency and accountability in corporate sustainability efforts. In this article, we delve into the requirements of the SEC's emissions disclosure rule and the types of businesses impacted.

The SEC ruling builds on a wave of recently passed regulations requiring climate-related disclosures. California recently passed new legislation, SB 253 and SB 261, requiring companies above a revenue threshold to disclose emissions and climate-related risks. Illinois and New York legislatures have similar legislation under consideration. In the EU, the Corporate Sustainability Reporting Directive (CSRD) established one of the most comprehensive sustainability reporting regimens globally, requiring companies to report on the impact of corporate activities across a broad range of environmental and societal categories.

One positive development is that, from a climate perspective, most of these new regulations build on guidelines from the Task Force for Climate-related Financial Disclosures (TCFD) and the Greenhouse Gas (GHG) Protocol, both of which are international standards that companies currently follow.

Rule highlights

Scope 1 and 2 emissions:

Large accelerated filers (LAFs) and accelerated filers (AFs) must disclose information on their material scope 1 and scope 2 emissions if not otherwise exempted. LAFs are public companies that have a market value greater than $700 million, while AFs have a market value between $70 and $700 million. For LAFs and AFs required to disclose their scope 1 and 2 emissions, they must also provide an assurance report at the limited assurance level. LAFs, following an additional transition period, must be at the reasonable assurance level.

Climate-related targets and goals:

Public companies must provide information on their climate-related goals and targets that materially affect or are likely to affect their business, financial condition, or results of operations. This includes material expenditures and material impacts on financial estimates and assumptions as a direct result of the target, goal, or actions taken.

Carbon offsets and renewable energy credits/certificates (RECs):

Public companies that have expenditures, capitalized costs, or losses related to carbon offsets and RECs will have to disclose those impacts if they are material to achieving their climate-related goals and targets.

Climate-related risks:

Public companies must disclose climate-related risks that have had, or are reasonably likely to have, a material impact on their financial condition, operations, or business strategy. Any actual or potential impacts for identified climate-related risks must also be disclosed if they have an impact on the business model, outlook, or strategy. Board oversight and any role management takes in assessing and managing the company’s climate-related risks must also be included in the disclosures.

Climate-related risk management, mitigation, and adaptation measures:

Any process public companies take to identify, assess, or manage climate-related risks must be disclosed as well as how the risks are being managed and how the processes are integrated into the overall risk management system. For registrants that have undertaken activities to adapt or mitigate for material climate-related risks, the SEC will require the disclosure of a quantitative and qualitative description of the material expenditures incurred, the material impacts on financial estimates, and any assumptions that directly result from mitigation and adaptation activities. Public companies must also report on activities taken to mitigate or adapt to a climate-related risk, such as scenario analysis, internal carbon prices, and transition plans.

Severe weather events and natural conditions:

Public companies will have to disclose capitalized costs, expenditures, losses, and charges that incurred due to severe weather or natural events, such as hurricanes, tornadoes, droughts, wildfires, flooding, extreme temperatures, and sea-level rise. These disclosures will be subject to applicable one percent and de minimis disclosure thresholds, included in an addition to the financial statements.

Implementation timeline

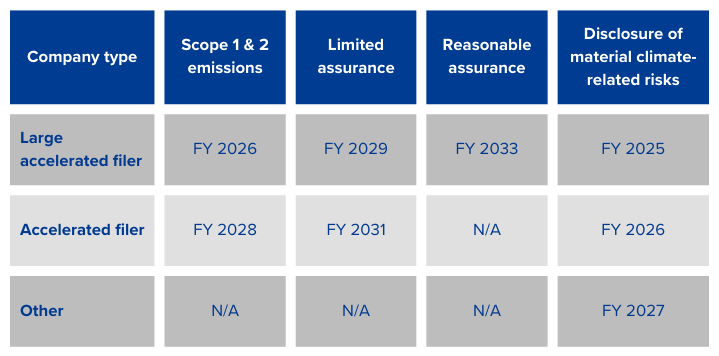

Climate risk disclosures will need to be included in a company’s SEC filings, such as annual reports and registration. The phase-in of the rule will depend on the size of the company. LAFs will be required to start reporting their climate-related risks for fiscal year 2025. The table below outlines the phasing in of the rule requirements, with reporting required in the second quarter following the relevant fiscal year.

Empowering corporate sustainability

The SEC's emissions disclosure rule represents a pivotal moment in the evolution of corporate sustainability. By mandating comprehensive disclosure of climate-related risks and emissions, the SEC empowers investors to make informed decisions and incentivizes companies to embrace sustainability as a driver of long-term value creation. By embracing sustainability as a catalyst for growth, organizations can forge a path towards resilience, innovation, and market leadership in the transition to a sustainable future.

Reach out to our team to learn how the SEC’s new rule may impact your business and the steps you can take to prepare to address these and related disclosure requirements.