California's bold step: Climate disclosure bills SB 253 and SB 261

November 3, 2023By Gregg Demers, ClimatePartner USA

Updated July 30, 2025

With climate change posing an imminent threat to our planet, governments worldwide are making significant strides to mitigate its impact. California, a leader in climate initiatives in the US, made headlines with the approval of two climate disclosure bills: SB 253 and SB 261. Signed into law in October 2023, these bills mark a decisive step toward a more sustainable future.

The California Air Resources Board (CARB), which is responsible for developing the implementing regulations, issued a Frequently Asked Questions document on July 9, 2025, providing an update on the status of the regulations and preliminary guidance for companies required to report in 2026. The document includes the initial concept for how "doing business in California" will be defined.

SB 253: Climate Corporate Data Accountability Act (CCDAA)

SB 253 mandates that from 2026 onward, public and private companies must disclose their scope 1, 2, and 3 emissions. To fall under the purview of SB 253, a corporation must do business in California and have an annual revenue of $1 billion or greater. It is expected that over 5,000 companies currently meet these requirements and will have to prepare to disclose their carbon footprint.

As recognized in the bill, carbon accounting is broken up into three scopes defined by the GHG Protocol. As organizations prepare to complete their carbon footprint, perhaps for the first time, it is important to understand what data is included under each scope:

- Scope 1 covers an organization’s direct emissions resulting from the on-site combustion of fossil fuels, for example: boilers or company vehicles.

- Scope 2 accounts for an organization’s indirect emissions from consuming energy that was generated off-site and purchased by the company, for example electricity, heating, cooling, or steam.

- Scope 3 encompasses the indirect emissions associated with all other activities of a business and its value chain, including upstream and downstream emissions. Examples include business travel, the production of purchased goods and services, and transportation.

Under SB 253, scope 1 and 2 emissions data from 2025 must be reported in 2026, while scope 3 emissions may be submitted a year later, in 2027 for 2026 data. In addition, reporting companies must have an assurance engagement completed by a third-party assurance provider. The level of assurance required will increase over time, with a limited assurance level starting in 2026 and a reasonable assurance level by 2027 for scope 1 and 2 emissions. Scope 3 emissions must be at the limited assurance level by 2030.

SB 261: Climate-Related Financial Risk Act (CRFA)

SB 261 will require companies to submit climate-related financial risk reports to the California Air Resources Board (CARB) starting in 2026. The law applies to companies formed in the US and doing business in California with annual revenues exceeding $500 million. The law is aligned with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).

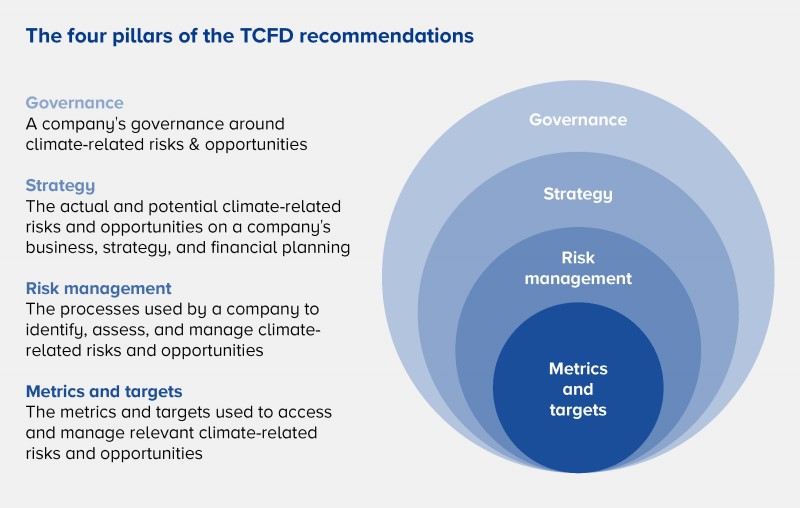

To be compliant with the new law, it is important to understand the TCFD recommendations. The recommendations are structured around four pillars.

Governance

- Roles and responsibilities: Describe the organization's governance structure as it relates to climate-related risks and opportunities. This includes specifying the roles and responsibilities of the board and executive management in the climate-related decision-making process.

- Board oversight: Explain how the board of directors oversees climate-related risks and opportunities.

Strategy

- Business strategy: Disclose how climate-related risks and opportunities are integrated into the organization's overall business strategy. This includes information on how the organization identifies and assesses climate-related risks and opportunities, as well as how it manages and mitigates them.

- Scenario analysis: Provide details on the resilience of the organization's strategy, taking into account different climate-related scenarios, including a 2°C or lower scenario.

Risk management

- Risk management process: Describe the organization's processes for assessing and managing climate-related risks. This includes information on the risk identification process, risk assessment methodologies, and the mechanisms in place to manage and monitor these risks.

- Integration of risks: Explain how climate-related risks are integrated into the organization's overall risk management process.

Metrics and targets

- Metrics: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities. This involves providing data on greenhouse gas emissions, energy consumption, and other relevant climate-related metrics.

- Targets: Specify the targets set by the organization to manage climate-related risks and opportunities. These targets could be related to reducing greenhouse gas emissions, increasing energy efficiency, or other climate-related goals.

Companies subject to the regulation must post a climate risk disclosure document on their own website by January 1, 2026, and then share that link on a portal that CARB will open on December 1, 2025.

Preparing for compliance

California's SB 253 and SB 261 climate disclosure bills set a high standard for transparency and accountability in the face of climate change. By imposing specific thresholds on corporations, these laws ensure that those with the most substantial environmental and financial impacts are at the forefront of climate risk disclosure.

ClimatePartner can help your organization prepare for compliance with these new laws, with robust services around calculating your scope 1, 2, and 3 emissions and evaluating your climate risks and opportunities. We also help companies set reduction targets and develop reduction strategies to reduce their overall emissions and mitigate climate risks.

Reach out to our team of climate experts to learn more about how we can support your the reporting requirements of SB 253 and SB 261. Also, if you'd like to learn more about climate disclosure regulations, check out the ClimatePartner Academy for a free session!